ISO 20022 was published in 2014 and is a global standard for financial messaging that provides a standard model across business domains such as payments, securities, trade services, card services, and foreign exchange (FX). The new standard defines messages between parties within a payment chain. It also defines message specifications for each message type.

It is envisaged that the transition to ISO 20022 will be completed by November 2025.

SWIFT MT vs MX

Two international standards are used as the global standard for financial messaging:

- SWIFT MT format

- This format was introduced in the 1970s and is still the dominant format having been updated several times.

-

- The MT format is relatively expensive due to the message size.

- ISO 20022 (MX format)

- The MX format was published in 2014 and aims to deliver improvements that will reduce manual intervention, improve process accuracy, and enhance fraud prevention measures

- It is better with XML format messages and allows a lot more data in a simplified format.

Why move to ISO?

The banking landscape is rapidly evolving. New ways of making payments are being introduced and it is now essential to make use of a common, modern, standard that can be leveraged globally. ISO 20022 will:

- Improve communication: XML based and easier for STP (Straight Through Processing).

- Data rich messages (Mining / Regulatory reporting / AML checks): More information on a single message will reduce payment failures.

- Support many languages other than English to include Chinese, Japanese, Arabic etc.

How ISO 20022 will benefit the banking community?

- Accuracy and efficiency: Information from different payment methods can be grouped and reused, so less manual input is needed along the payments chain. This results in fewer errors and inconsistencies, which enables the payment to reach its intended destination the first time.

- Transparency and compliance: ISO 20022 messages carry more detailed information than SWIFT MT or other messaging formats. This promotes anti-money laundering and sanctions screening compliance by improving transparency.

- Seamless processing: The inherent flexibility in ISO 20022 eliminates the mapping of different payment standards and facilitates better straight-through-processing.

- Lowers costs: Eliminating global barriers and improving accuracy and efficiency reduces the overall cost of each payment transaction.

- More business opportunities: Interoperability makes it easier for smaller players to transact business globally and play a significant role in the banking industry.

Timeline for the transition from MT to MX

SWIFT has established a three-year period, beginning November 2022, to transition from SWIFT MT formats to ISO 20022 compliant messages (MX formats). The three-year transition period will end in November 2025.

Between November 2022 and November 2025, both MT and MX message formats will be supported and will coexist. After November 2025, SWIFT MT messages will be decommissioned, and ISO 20022 will be the only acceptable standard for cross-border payment instructions and reporting messages between financial institutions.

Scope of this transition

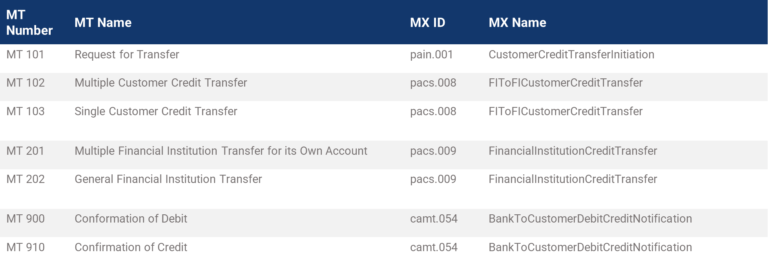

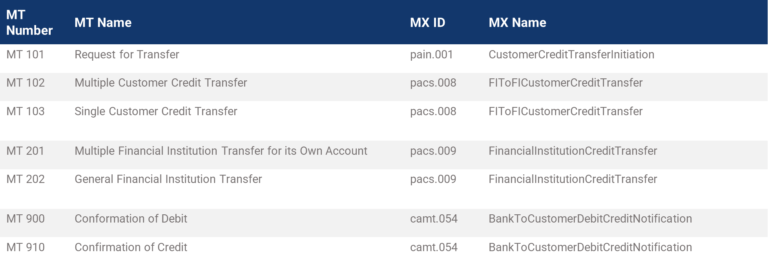

All international cross-border payments and domestic high-value payments (RTGS / TARGET 2) are to be moved to the MX format. Hence the following MT’s are being moved to MX format in the current program:

- SWIFT MT 1 series – Customer payments

- SWIFT MT 2 series – Financial Institution payments

- SWIFT MT 9 series – Statements

Note, the rest of the series will remain in SWIFT MT format

Approach by banks and financial institutions

Careful planning by banks can facilitate the transition to ISO 20022:

- Engaging with SWIFT message experts to support all software changes and handle the change management.

- Understanding the functions and internal departments likely to be impacted.

- Identifying vendor systems and other IT infrastructure that will be impacted.

- Allocating adequate budget to ensure resources are available for the duration of the project.

- Testing interfaces and messages with all entities, including counterparties, customers, vendors and other stakeholders. Investing in staff training and ongoing communications to ease the transition.

MX message equivalents of MT message types

How Brickendon can help?

Brickendon has developed a three-phase approach to identify the opportunity, validate the transformation, and transition to a steady state:

- Identification and Impacts

- Assess existing payments architecture (note that this is region specific).

- Impact Analysis:

- Understand regulators and routing mechanisms specific to the country.

- Identifying systems and processes impacted by the transition.

- Planning & Design

- Planning should consider the entire transformation program and should be divided into phases aligned with the industry SWIFT rollout.

- The scope should include:

- Changes to the payments engine.

- Changes to interfaces connecting the bank with the payment routing channels.

- Payment architecture supporting both MT and MX formats concurrently.

- The file format of inward and outward payments is to be modified.

- Development & Delivery

- The proposed design should be developed in modules.

- The test region should undergo Unit Testing, System Testing & Integration Testing.

- Modules should be deployed in production in a phased manner. Production support should be provided to monitor and resolve any issues.

Let us help you prepare for the coming changes

Explore the latest Insights from Brickendon and ensure that your organisation is prepared.

Click Here